As Orlando's real estate market continues to boom, property managers find themselves juggling an ever-growing portfolio of vacation rentals and long-term leases.

With the city welcoming over 74 million visitors in 2023 alone, according to VisitOrlando, along with its rising population, the need for accurate records has never been higher.

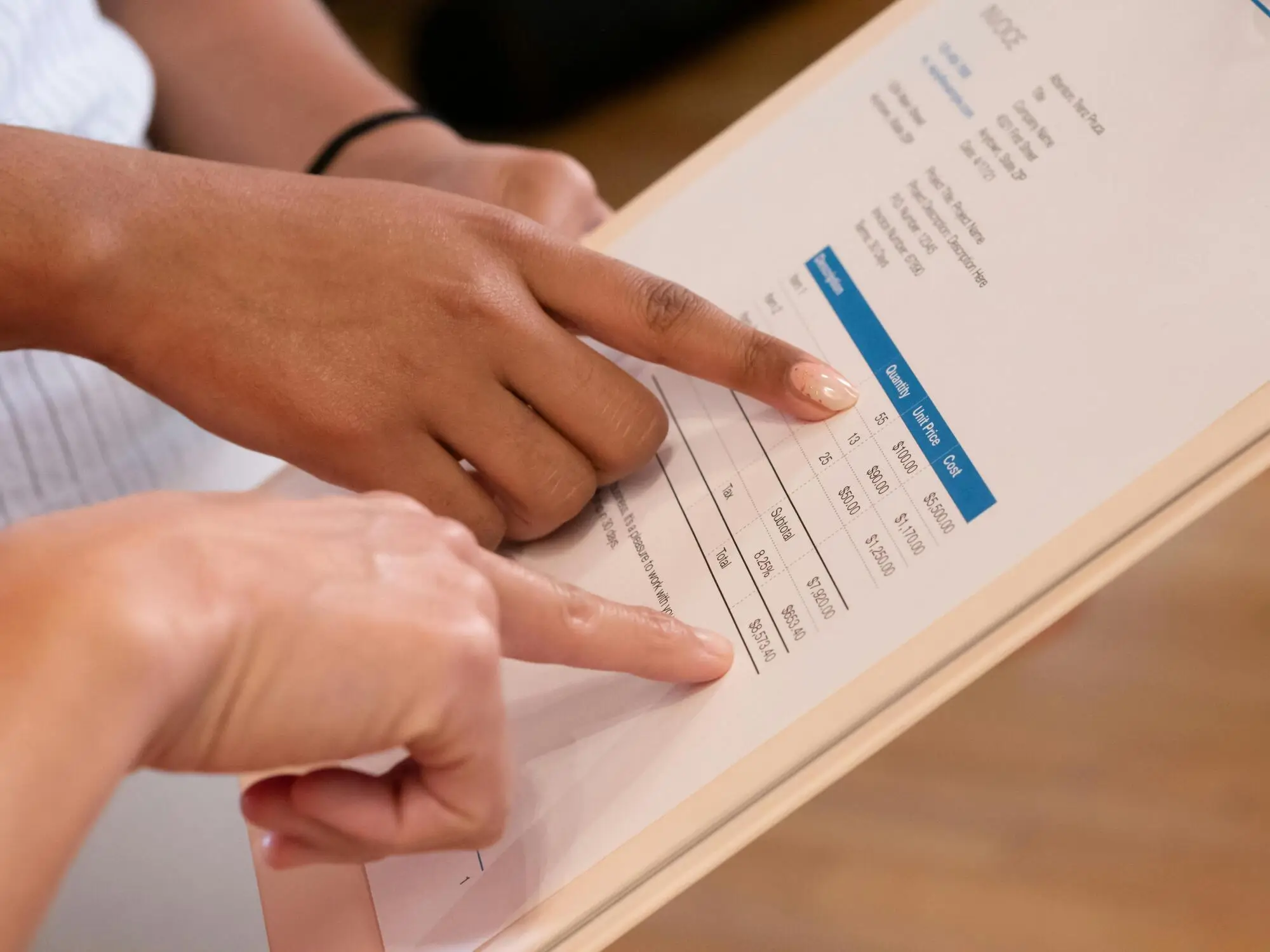

However, many local firms still grapple with outdated financial reporting strategies, leading to countless hours spent on paperwork and an increased risk of errors.

That's where accurate paperwork becomes so important.

Read on to learn what you need to know about owner statements and reporting in Orlando.

Accurate Record Keeping and Data Storage

Proper record-keeping allows landlords to track all:

- Income

- expenses

- Other financial transactions

associated with their property, ensuring transparency and compliance with local regulations. When you keep accurate owner statements and other records,

landlords can more easily prepare for tax filings, audits, and property evaluations, reducing the risk of errors or missing data that could negatively impact financial planning.

Don't be afraid to use the cloud to make your life easier. Cloud storage not only protects sensitive information from potential physical damage, such as a fire or flood, but also allows landlords to access important records from anywhere, offering greater flexibility.

Hire Property Managers

Bring in the experts if you need them. These professionals have the expertise to:

- Streamline rent collection

- Track expenses

- Maintain detailed financial records

which are crucial for tax filings and long-term property performance analysis.

By sharing their property management insights, property managers help landlords stay informed and organized, offering peace of mind and freeing up valuable time to focus on other investments or personal endeavors.

Ongoing Communication and Clarifications

Make sure you communicate with all involved parties.

Open lines of communication allow property owners to seek clarifications on:

- Rental income

- Expenses

- Maintenance costs

- Any discrepancies

This proactive approach builds trust and helps prevent misunderstandings that could lead to financial issues down the road.

Cash Flow Projections

Cash flow projections help you determine whether your property is generating a positive or negative cash flow, giving you the ability to plan for maintenance, upgrades, or potential vacancies.

Regularly reviewing these projections allows you to adjust rent prices, reduce unnecessary costs, or explore refinancing options to enhance your investment's profitability.

Emergency Fund Planning

Setting aside funds for unexpected expenses, such as emergency repairs, legal issues, or sudden vacancies, helps safeguard your property investment. A well-maintained emergency fund ensures that you can quickly address any unforeseen situations without disrupting your cash flow or profitability.

Allocate a portion of your rental income towards an emergency fund, ideally between 3-6 months of operating expenses. This proactive approach enables property owners to handle emergencies with ease, avoiding the need to tap into personal savings or take out loans.

Orlando Owner Statements and Reporting: Start Today

There's a lot that goes into accurate owner statements and reporting that you might not have thought about. With this guide, you should have a much easier time.

Do you need more property management tips? Check out RightHouse Realty LLC. Our company has quickly established itself as a solid partner for investors like you since we were founded in 2021.

Contact us today.